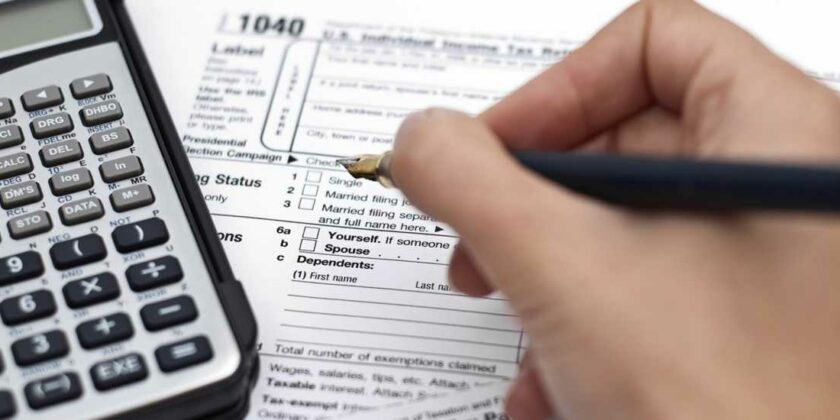

Services

Accounting services in the Netherlands can represent a valuable asset for any company since it can help smoothly run a business. The Netherlands Government has emitted laws and regulations meant to increase the efficiency and facilitate entrepreneurial activities. It is a very open country to global commerce and the judicial system…