Businessmen from foreign countries, as well as foreign natural persons, are allowed to purchase properties in the Netherlands, which can be used for personal or business purposes. When engaging in such an investment, it is important to know what the applicable property taxes are in the Netherlands regarding this matter. Our Dutch accountants specialize in advising our clients on a wide range of taxes, including the ones applicable to the transfer of property ownership.

If you have any question or need assistance in understanding how real estate property is taxed in the Netherlands, you can rely on our accountants.

| Quick Facts | |

|---|---|

| Possibility to acquire a Dutch property as a foreign citizen (YES/NO) |

YES |

|

Existence of property tax in the Netherlands (YES/NO) |

YES, there is a property tax in the Netherlands |

|

Special law available (YES/NO) |

YES, the Valuation of Immovable Property Act |

| Payment requirements |

Dutch propety tax must be paid annually |

| Authorities to pay the tax with (national/local) | Local municipality |

| Special requirements applicable to Dutch properties |

The value of the property is established based on ownership or use |

| Property tax payment requisites for non-residents |

Non-residents must pay the property tax in the Netherlands

|

| Payment due date | January 1st for the past year |

| Property tax rates | Property tax rates in the Netherlands are established by the local municipalities |

| Property tax exemptions available (YES/NO) | NO |

| Property tax deductions availability (YES/NO) | Interest payments and mortgages can be deducted from the property tax in the Netherlands |

| Special requirements for commercial property owners (YES/NO) | YES, these must pay real estate transfer tax upon acquisition |

| Dutch Box System applicable to real estate ownership | Box 1 for properties held as main residence, Box 3 for vacation homes or other purposes |

| Other real estate taxes in Netherlands |

Waste collection and sewage levies, water purification tax |

| Support in filing property tax documents (YES/NO) | YES, we can offer support in matters of property taxation in the Netherlands |

What are the main property taxes in the Netherlands?

In the Netherlands, immovable real estate property is taxed with the property tax, a type of tax that has to be paid on a yearly basis; the property tax is administered by the local Dutch municipalities. This tax represents a fraction of the property value –per mille type of tax – as estimated yearly by the local city hall. This property estimation is called a WOZ value.

The property tax in the Netherlands is divided into two main types – the tax that must be paid by the owner of a real estate property and a tax that has to be paid by the user of a property which belongs to another person. Regardless of what is the quality of the person liable for taxation, the tax must be paid no later than 1st of January for the year that has just ended; our accounting firm in the Netherlands can offer more information on the formalities that have to be completed in this case.

A non-resident tax payer (an individual who does not reside in the Netherlands and invests in Dutch real estate) used to pay a tax typically imposed at a rate of1.2%over the WOZ value minus a loan (if applicable), for the purchase of the Dutch property.

However, since this type of tax is imposed by each Dutch municipality, its value can range based on the location where the property is registered, but it can also be modified from a financial year to another, depending on the various market indexes. Our team of Dutch accountants can provide further information on the tax law regulating this issue.

In case a loan was not made, the property taxation in the Netherlands for a non-resident is of1.2% of the WOZ value (the price of the home at the official listed value). Our accountants in the Netherlands can provide more details on this issue, but it is important to know that the value of the WOZ can vary depending on the value of the property and on the latest tax modifications imposed by the local authorities.

The value of the WOZ (which refers to the valuation of a immovable property in the Netherlands), is done in accordance with the regulations of the Valuation of Immovable Property Act; under its regulations, the municipalities are allowed to determine the value of the WOZ on a yearly basis; more information concerning the stipulations of this law can be obtained from our team of accountants in the Netherlands.

Besides the above mentioned property taxes, the purchase of real estate properties is also imposed with the transfer tax. When buying a property in the country, the buyer has to pay such a tax which represents2% of the market value of a home bought as a private residence and of 6% of the property market value for other types of immovable real estate. Our team of Dutch accountants can provide more information on this type of tax, but it is important to find out that the following are applicable:

- • the transfer tax is imposed at a rate of 6% in the case of commercial immovable properties;

- • the property transfer tax must also be paid by those owning shares in companies that have assets that are considered real estate properties;

- • this regulation is applicable in the case of shareholders investing in partnerships, public limited companies or private limited companies;

- • the payment of the transfer tax is done through a deed of transfer, a procedure which can be completed through a local public notary;

- • the tax has to be paid with the Dutch Tax and Customs Administration;

- • there are exemptions on the payment of the property transfer tax in the case in which a businessman transfers the ownership rights on the respective property to a relative;

- • the same regulation applies when a company owning property transfers its real estate assets to another company, registered as private limited company.

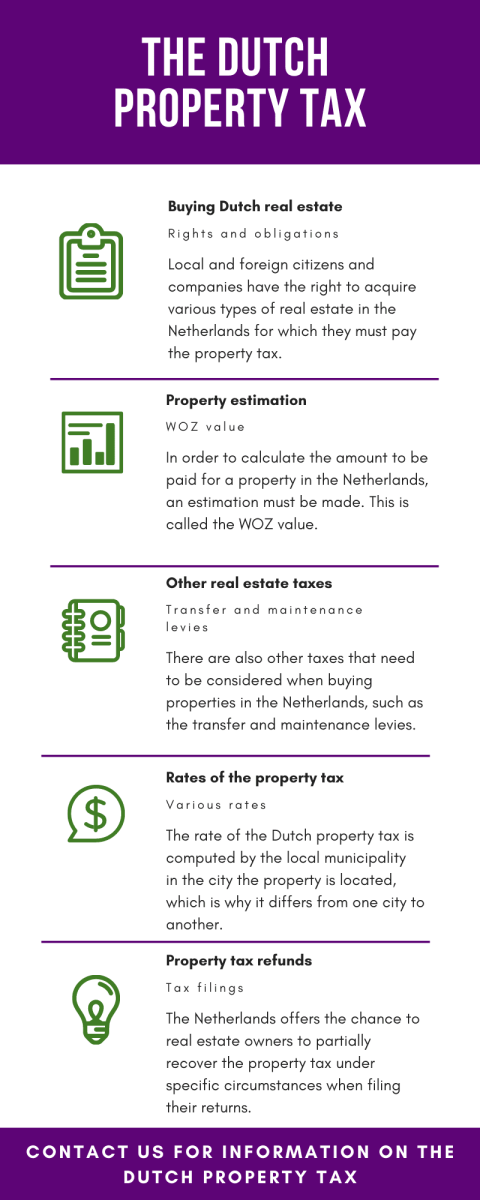

The infographic below shows how the Dutch property tax in levied:

Is WOZ used for Dutch rental system?

Yes, the WOZ is also used when renting a property in the Netherlands. In this country, when renting a property, there are two basic systems – social housing, which refers to properties that are rented by the local authorities, and properties that are available at the level of the private sector.

The WOZ value is calculated depending on the type of property that is available for rental and our team of Dutch accountants can provide more details referring to this system. In the case of a rental property that is considered a social housing, the WOZ value is calculated based on a points system, that is used to determine a maximum amount of rent that can be charged to a person.

In the case of properties belonging to the private sector, the WOZ value is not used for establishing the maximum value of a rental price. It is also necessary to know that the local authorities will inform those who need to pay the yearly property taxes on the current valuation of the property. However, each real estate owner is allowed to request information on the manner in which the property was valuated and an objection can be made in this sense, by filling the objection form attached to the tax assessment.

Other types of taxes when purchasing a Dutch property

It is important to know that, besides the taxes presented above, the procedure of purchasing a real estate property can be imposed with additional taxes. Our Dutch accountants can advise local and foreign persons wishing to purchase a property here on the manner in which such taxes are applied, and can present in-depth details other taxes that can apply when one acquires a property in the Netherlands. Some of the most important taxes are the following:

- • transfer tax, imposed at a rate of 2% of the value of the property (a non-negotiable tax);

- • pre-sale agreement deposit, representing 10% of the value at which the property is sold and it is important to know that most of the agreements will generally apply this rate;

- • transfer contract tax, imposed at a rate of 0.3% of the purchase price;

- • mortgage cost is typically imposed at a rate of 1% of the purchase price;

- • mortgage contract will have a value of 0.15% of the purchase price and it is a tax deductible procedure;

- • if the property was purchased through a real estate agent, thefee is generally imposed at a rate of 2% of the property’s market price;

- • valuation of the property is imposed with a tax of 0.2% of the purchase price, but the tax rate can be negotiated.

Are there any other taxes applicable to Dutch properties?

Yes, owners of properties in the Netherlands, regardless if they are registered as residential or commercial properties, are required to pay other taxes associated with the maintenance of the property. The Netherlands applies awaste collection levy used for thecollection and disposal of garbage and it is computed depending on the number of persons living in a household. At the same time, the value of the tax can vary depending on the municipality in which the residence is set up.

Owners of Dutch properties are also liable tosewage levy and to the water board tax, as well as to the water purification levy. In the situation of properties that are not connected to the local sewage system, the local authoritiesapply a pollution levy. It is also necessary to mention that certain municipalities in the Netherlands impose a dog tax for the property owners who have a dog; however, this tax is not applicable in Amsterdam starting with 2016.

Tax returns for real estate property in the Netherlands

Under the Dutch taxation system, both local and foreign citizens or companies owning real estate in this country need to file tax returns. The advantage of filing tax returns in this country is that for foreign citizens, the authorities here give them the right to claim various tax benefits under the form of deductions from certain levies.

With respect to the Dutch property tax, residents of this country need to report their income and assets earned, respectively owned everywhere in the world when filing their tax returns. In the case of non-residents, they need to declare the real estate owned in the Netherlands.

Taxation in the Netherlands relies on the box system which requires natural persons to check specific boxes which corresponds to their tax situation. When it comes to the property tax, a Dutch resident needs to check the following:

- – Box 1 if they own a property they use as a main place of residence;

- – Box 3 if they own one or more properties which are not the main residence.

When checking Box 1, the Dutch resident can be subject to property tax deductions for mortgage interests, notary fees and the purchase costs associated with the mortgage. For properties entering the Box 3 category, they will be subject to taxation at the WOZ value from which the mortgage value is deducted.

From a reporting point of view, all properties entering the possession of a Dutch resident starting with January 1st must be declared in the tax return for the respective year.

Dutch citizens with real estate properties abroad must declared them in their tax returns submitted in the Netherlands, however, it should be noted that in this case, special rules under double tax treaties (where such treaties exist) apply. This means that Dutch residents will need to pay the property tax in the country where the real estate is located. Where a double tax treaty applies, citizens or residents of the Netherlands are entitled to tax reliefs equal to the taxes they would pay in the Netherlands.

If you need assistance related to filing personal tax returns, you can rely on our Dutch accounting firm.

Businesspersons doing business through companies can also benefit from our audit services in the Netherlands.

The Dutch property tax for non-residents

Foreign citizens who do not have residence permits for the Netherlands can own real estate here. Just like in the case of Dutch residents, in the case of foreign citizens, the property tax on real estate will be paid here. If between the country of origin of the foreign citizen and the Netherlands a double tax agreement is in place, the conditions of the respective treaty will apply.

As a real estate owner in the Netherlands, a foreign citizen is required to report the property with the Dutch tax authorities in order to pay the property tax. Just like in the case of residents, Box 3 on the tax return must be checked and the tax paid will be calculated at WOZ value from which the mortgage will be deducted (if it is the case).

Our accounting firm in the Netherlands can provide extended assistance to foreign citizens and investors liable for taxation in this country. Also, where a double tax treaty is in place, our accountants will consider the provisions of the respective convention to the best interest of the client.

Deductions of the property tax in the Netherlands

Interest payments on mortgages aredeductiblefrom the property tax in the Netherlands if the property is used as a principal residence and if the owner is a registered resident of the country. Mortgage interest can be deducted over the amount of the mortgage, except for any the portion of the loan utilized to acquire furniture or any other type of consumer products. Thisrefundcan be demanded in advance and refunded monthly.

Residents of the Netherlands candeduct their mortgage interest pay only on their main residence and have to pay a wealth tax on any other supplementary real estates they own in the country. Partial non-residents, though, can deduct the mortgage interest pay on their main residence, however they do not pay the wealth tax on other real estate they own in the Netherlands.

Changes in the property tax system in the Netherlands

In 2020, the taxation of real estate has suffered a few modifications. The changes refer to Dutch properties held as main places of residence, but also to those held as investments. It is important to note that in 2020, the rental value represents 0.60% of the WOZ value for properties valued below 1,090,000 euros. For properties exceeding this value, the WOZ value is 2.35%.

For real estate where mortgage interests are deductible, the highest deduction rate for 2020 is 49.50% to which a tax rate correction of 3.50% is added.

The Box system is subject to minor changes every year which is why when filing tax returns the assistance of an accounting firm in the Netherlands is necessary for a correct submission. This way, you will be able to take advantage of all tax benefits offered by the local authorities.

You can also rely on us for information on the income tax incentive available when buying a property in the Netherlands. Our accountants in the Netherlands can help you apply for various tax deductions and reliefs.

You can also watch our video below:

What are the current prices for Dutch residential real estate properties?

Foreigners wishing to purchase a property in the Netherlands with the purpose of relocating here must know that the prices for residential real estate properties expanded due to the increasing demand. The prices increased for all types of residential properties and the latest data presented by the Statistics Netherlands, the country’s national statistics office, show the following:

- • in Amsterdam, the prices for residential properties increased by 6,23% ( measured at the level of the first quarter of 2019);

- • the current average price of a property in Amsterdam stands at EUR 472,375;

- • at a national level, the average increase for a property stood at 8,31%;

- • in the latter case, the average price for a Dutch property is of EUR 301,279;

- • the price of an apartment in the Netherlands has an average value of EUR 264,409;

- • the average price for a terraced house in the Netherlands is of EUR 278,167;

- • a detached house in the Netherlands has a price of EUR 437,633;

- • a semi-detached house has an average price of EUR 319,663.

It is important to know that other types of taxes are deductible in the Netherlands – for example, the closing fee established with a bank when concluding a mortgage on a real estate property, a situation which is also applicable to notary costs related to the registration of the mortgage. We invite you to get in touch with our accountants in the Netherlands for any further information on the Dutch property tax.